Opportunity Zones were enacted as part of the 2017 tax reform package (Tax Cuts and Jobs Act) to address uneven economic recovery and persistent lack of growth that have left many communities across the country behind. In the broadest sense, the newly enacted federal Opportunity Zone program provides a federal tax incentive for investors to invest in low-income urban and rural communities through favorable treatment of reinvested capital gains and forgiveness of tax on new capital gains.

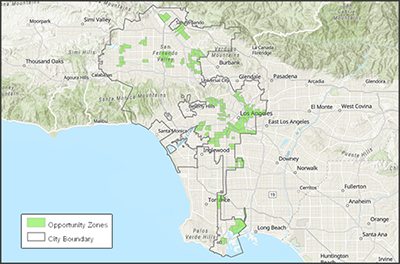

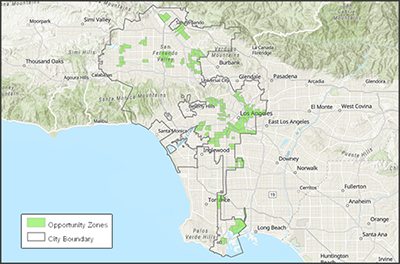

The City of Los Angeles has 193 Opportunity Zones approved in 13 Council Districts. View the Los Angeles Economic Incentive Areas map on the LA Department of City Planning website to locate zones within the City.

This economic and community development tax incentive program provides a new impetus for private investors to support distressed communities through private equity investments in businesses and real estate ventures. The incentive is a deferral, reduction and potential elimination of certain federal capital gains taxes.

Qualified Opportunity Zones retain this designation for 10 years. Investors can defer tax on any prior gains until no later than December 31, 2026, so long as the gain is reinvested in a Qualified Opportunity Fund, an investment vehicle organized to make investments in Qualified Opportunity Zones. In addition, if the investor holds the investment in the Opportunity Fund for at least ten years, the investor would be eligible for an increase in its basis equal to the fair market value of the investment on the date that it is sold.

The City of Los Angeles has 193 Opportunity Zones approved in 13 Council Districts. View the Los Angeles Economic Incentive Areas map on the LA Department of City Planning website to locate zones within the City.

This economic and community development tax incentive program provides a new impetus for private investors to support distressed communities through private equity investments in businesses and real estate ventures. The incentive is a deferral, reduction and potential elimination of certain federal capital gains taxes.

Qualified Opportunity Zones retain this designation for 10 years. Investors can defer tax on any prior gains until no later than December 31, 2026, so long as the gain is reinvested in a Qualified Opportunity Fund, an investment vehicle organized to make investments in Qualified Opportunity Zones. In addition, if the investor holds the investment in the Opportunity Fund for at least ten years, the investor would be eligible for an increase in its basis equal to the fair market value of the investment on the date that it is sold.

Frequently Asked Questions About Opportunity Zones

-

What is an Opportunity Zone?

An Opportunity Zone is an economically-distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. Localities qualify as Opportunity Zones if they have been nominated for that designation by the state and that nomination has been certified by the Secretary of the U.S. Treasury via his delegation of authority to the Internal Revenue Service.

-

Are Opportunity Zones the same as other programs like Empowerment Zones, Enterprise Zones, or Promise Zones?

No. While Opportunity Zones may share some similarities with these earlier programs, this is a brand-new policy.

-

What is the purpose of Opportunity Zones?

Opportunity Zones are an economic development tool that is designed to spur economic development and job creation in distressed communities.

-

How do Opportunity Zones spur economic development?

Opportunity Zones are designed to spur economic development by providing tax benefits to investors.

First, investors can defer tax on any prior gains invested in a Qualified Opportunity Fund (QOF) until the earlier of the date on which the investment in a QOF is sold or exchanged, or December 31, 2026. If the QOF investment is held for longer than 5 years, there is a 10% exclusion of the deferred gain. If held for more than 7 years, the 10% becomes 15%.

Second, if the investor holds the investment in the Opportunity Fund for at least ten years, the investor is eligible for an increase in basis of the QOF investment equal to its fair market value on the date that the QOF investment is sold or exchanged. -

What is a Qualified Opportunity Fund?

A Qualified Opportunity Fund is an investment vehicle that is set up as either a partnership or corporation for investing in eligible property that is located in a Qualified Opportunity Zone.

-

Do I need to live in an Opportunity Zone to take advantage of the tax benefits?

No. You can get the tax benefits, even if you don’t live, work or have a business in an Opportunity Zone. All you need to do is invest a recognized gain in a Qualified Opportunity Fund and elect to defer the tax on that gain.

-

Where are the Opportunity Zones located in California and Los Angeles?

The Department of Treasury has certified 879 census tracts in California as Qualified Opportunity Zones. Resources and mapping tools can be located on the California Department of Finance Opportunity Zones in California page.

In the City of Los Angeles, there are 193 Opportunity Zones. Review the LA City Planning Department's Opportunity Zones Map for eligible tracts within the City boundaries. -

How do I invest in an Opportunity Zone in California?

Additional investor tools are located in the CA Opportunity Zone Toolkit. A national Opportunity Fund directory can be found here.

The Questions and answers were compiled by the U.S. Internal Revenue Service irs.gov and the California State Opportunity Zone web portal.

Additional Resources

- What Are Opportunity Zones

City of LA, Economic & Workforce Development Department - California Opportunity Zone Portal

- CDFIFund.gov - Opportunity Zones Resources

- IRS.gov - Opportunity Zones FAQs

- IRS Issues Guidance On Opportunity Zones To Spur Private Investment In Distressed Communities treasury

(8 February 2018, US Treasury Press Release) - Investing in Qualified Opportunity Funds

29 October 2018, Proposed Rule by the IRS